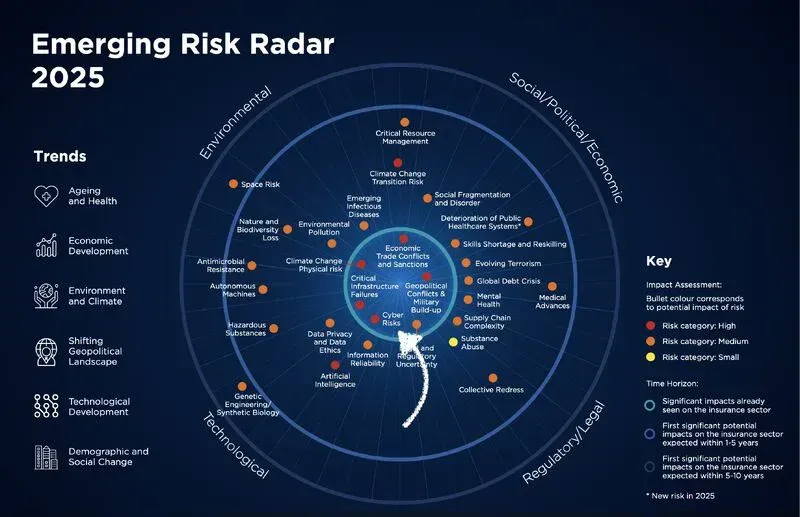

Emerging Risk Landscape 2025: Navigating the New Era of Insurance Challenges

The insurance industry stands at a critical juncture as 2025 unfolds, facing an unprecedented convergence of technological, environmental, and societal risks that are reshaping the very foundation of risk assessment and coverage. According to the latest Emerging Risk Radar and industry reports, artificial intelligence has surged to the top of global risk indices, while climate change continues to drive massive losses, with catastrophic events already costing $162 billion in the first half of 2025 alone.

The AI Revolution: Both Threat and Opportunity

Artificial Intelligence Dominates Risk Rankings

For the first time, artificial intelligence has displaced all other concerns to become the top-ranked risk for the insurance sector in 2025. This seismic shift reflects the rapid pace of AI adoption across industries and the emerging understanding of its far-reaching implications for insurers.

The Scale of AI Impact

AI adoption in insurance has grown by 25% in the past year, and by 2025, it is estimated that 95% of customer interactions in the insurance industry will be facilitated by AI. However, this transformation brings significant risks:

- Silent AI Coverage: Similar to the "silent cyber" issue, insurers face the challenge of unintentional AI coverage in policies that weren't designed or priced for AI-related risks

- New Attack Vectors: AI enables sophisticated cyber threats, including deepfake technology for fraud and AI-powered phishing campaigns

- Liability Questions: Emerging AI exposures include software malfunctions, algorithmic biases, and cybersecurity vulnerabilities that challenge traditional coverage models

Insurance Industry Response

By 2032, insurers could potentially generate approximately $4.7 billion in annual global premiums from AI-related insurance, but this opportunity comes with the need for new underwriting approaches and policy language to address AI-specific risks.

Climate Change: The Persistent and Escalating Threat

Record-Breaking Losses Continue

Global insured losses from natural catastrophe events reached $100 billion in the first half of 2025, making it the second-highest 1H total on record. The impact is particularly severe in the United States, which accounted for $126 billion of the total global economic losses, marking the costliest first half on record for the country.

Physical and Transition Risks

Climate change presents a dual challenge for insurers:

- Physical Risks: More frequent catastrophic events, combined with the need to meet evolving regulatory requirements, can threaten company business models and make insuring some risks unaffordable for customers or unfeasible for insurers

- Transition Risks: The potential costs to society of evolving to a low carbon economy, which can arise from changes in public sector policies, innovation, and changes in the affordability of existing technologies

The Insurance Protection Gap

Despite the growing losses, the amount of uninsured global losses has dropped to a record low of 38%, reflecting the growing maturity of the US market. However, significant gaps persist in emerging markets and developing economies.

Cyber Threats: The Evolving Digital Battleground

Market Growth and Sophistication

The global cyber insurance market was worth about $13 billion in 2023, almost double the $7 billion estimated size in 2020, with forecasts suggesting that cyber insurance will grow into a $22.5 billion industry by 2025.

Key Cyber Risk Drivers for 2025

According to industry experts, the five most significant drivers of cyber claims are: non-breach privacy claims, supply chain events, organized criminal groups, non-malicious incidents, and the amplification effects of AI.

Supply Chain Vulnerabilities

Events like the CrowdStrike incident demonstrate how a single software update error can cause massive system outages worldwide, showing that cyber policies cover not just malicious acts but also non-malicious and unintentional ones.

Aging Population: The Demographic Time Bomb

Healthcare Cost Pressures

The global population aged 60 and over is expected to grow from approximately 900 million in 2015 to over 1.2 billion by 2025, and by 2050, this population is projected to reach two billion, or 22% of the total population.

Insurance Implications

The aging demographic creates multiple pressures:

- Healthcare Costs: Some studies predict that approximately 20% of healthcare spending growth will be attributed to aging by 2025

- Long-term Care: By 2050, the population of Americans age 65 and older is projected to increase by more than 50%, with more than half expected to experience serious long-term care needs

- Insurance Affordability: Due to increased risk, insurance premiums rise significantly with age, with marketplace premiums being up to three times more costly for older individuals

Social and Political Risks: The Fabric of Society Under Stress

Social Inflation and Nuclear Verdicts

Social inflation continues to escalate claim costs associated with nuclear verdicts and rising litigation expenses, weighing heavily on casualty and liability lines. This trend is particularly pronounced in the United States, where large jury awards are becoming increasingly common.

Trust and Regulatory Challenges

One major structural risk is the significant lack of consumer trust in insurers, which affects policy sales and can lead to reputational issues and regulatory pressure. This trust deficit complicates efforts to introduce new products and pricing models needed to address emerging risks.

Environmental and Biodiversity Risks

Nature-Based Solutions and New Exposures

Natural infrastructure can mitigate disaster risks, support adaptation, and provide significant health benefits, with leading insurers creating new products to protect ecosystems and reduce risks associated with nature-based solutions.

Emerging Health Risks

New risks include the impacts of extreme heat, fungal disease spreading with building resistance, harm caused by plastics, and potential claims from increased consumption of ultra-processed foods.

Technological and Space Risks

Space-Based Threats

The 2025 Emerging Risk Radar highlights space risks as a growing concern, particularly as satellite infrastructure becomes increasingly critical for communications, navigation, and financial systems. Solar flares and space debris pose significant threats to this infrastructure.

Autonomous Systems and Robotics

Emerging technologies such as AI and virtual assistance, including robotics-assisted surgery, could improve healthcare delivery outcomes, but process failures could also introduce product liability and professional indemnity risks.

Strategic Recommendations for Insurers

1. Proactive Risk Assessment

- Develop AI-specific underwriting capabilities and policy language

- Implement climate scenario modeling across both underwriting and investment portfolios

- Invest in new capabilities to help manage, mitigate, and transfer risks related to natural disasters

2. Innovation and Adaptation

- Consider multi-year policies and parametric insurance products to address increasingly severe weather trends

- Explore partnerships with infrastructure funds, private-equity funds, and other institutional investors to diversify risks while providing access to data and technical expertise

3. Regulatory Preparedness

- Better disclose and showcase the efficacy of activities and actions taken to assess and mitigate climate-related risks to reassure regulators

- Prepare for increased climate-related disclosure requirements and stress testing

4. Market Education and Trust Building

- Address the consumer trust deficit through transparent communication and fair pricing practices

- Educate clients about emerging risks, particularly AI and cyber threats

Looking Ahead: A Complex Risk Landscape

The 2025 emerging risk landscape represents a fundamental shift in how insurers must approach risk assessment, product development, and customer relationships. As the insurance industry evolves to meet changing demands, the rise of better decision-making tools and a growing understanding of systemic risks are paving the way for innovative risk transfer solutions.

The convergence of artificial intelligence, climate change, demographic shifts, and evolving social dynamics creates both unprecedented challenges and significant opportunities. Success in this environment will require insurers to be more agile, data-driven, and collaborative than ever before.

The momentum toward net-zero emissions is undeniable, and no other industry has a more crucial role in helping societies and businesses adapt to climate change and the transition to net zero than insurance. As the industry navigates these complex risks, the ultimate goal remains unchanged: protecting society while maintaining financial stability and sustainable growth.

The insurers that thrive in 2025 and beyond will be those that embrace innovation, invest in understanding emerging risks, and maintain a commitment to serving their customers and communities in an increasingly uncertain world.